Don’t Let Elections Derail Your Retirement Strategy

How might the upcoming election impact your retirement savings? Or should you change your investment strategy based on the current political climate? These are typical concerns for many investors, as elections can create uncertainty.

Elections tend to evoke many emotions—whether fear, excitement, or something in between. This emotional state often leads people to make rash financial decisions they later regret. However, history has shown us that the market trends upward over the long term, regardless of which political party is in power. While elections can cause short-term market fluctuations, sticking to a sound, personalized investment strategy is crucial for achieving long-term financial goals.

Market Performance vs. Political Party

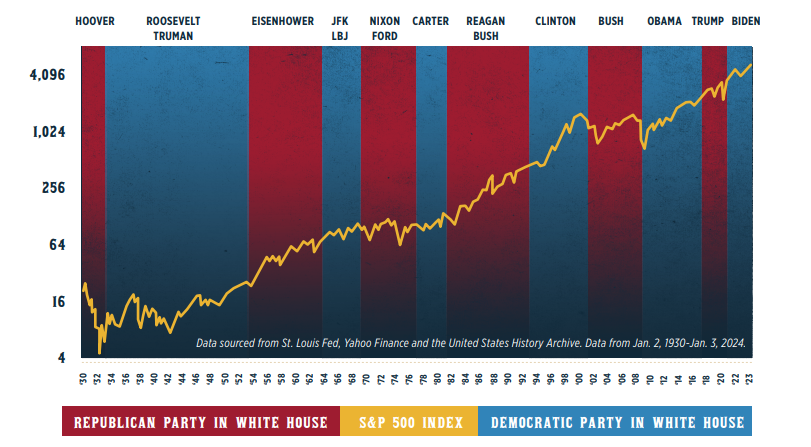

Take a look at this illuminating chart showing the S&P 500’s performance through various presidents, from Herbert Hoover to Joe Biden.

Despite the vastly different policies, ideologies, and leadership styles, one thing is clear – the market has climbed over time under both Republican and Democratic administrations. Equity markets have flourished regardless of which party controlled the White House.

Why Elections Don’t Derail the Market

There are a few key reasons markets are resilient in the face of political changes and new administrations taking over. First, the market focuses on the long-term economic factors that transcend any single presidency or election cycle. While the domestic political landscape can influence market performance over shorter periods, investors have come to expect the regular ebb and flow of power between parties.

Additionally, while US politics obviously impacts the domestic economy, markets are influenced by global economic forces and cycles that reach far beyond any single country’s leadership. The increasingly interconnected global economy and markets ensure that no single election or political regime can completely derail the entire system.

Sticking to Your Plan is Key

Your investment strategy should be based on goals, timelines, risk tolerances, and life situations rather than daily political headlines and rhetoric. Making knee-jerk investment decisions fueled by fear, euphoria, or media hype whenever a new party takes power can significantly derail your ability to achieve your long-term objectives.

A well-constructed plan should be built to withstand the political noise and market volatility during election cycles. Changing your long-term strategy based on transient political shifts is a recipe for speculation rather than prudent investing.

Consider a Review, Not a Revamp

That said, whenever major life events or changes occur, reviewing your financial plan with an experienced advisor is wise to ensure it remains aligned with your current goals and situation. However, you’ll want to only partially revamp your investment strategy purely based on election results or candidates’ rhetoric. A skilled financial advisor can help you look past the political storms and stay focused on your long-term path.

Conclusion

While elections amplify market volatility and anxiety in the short term, prudent investors know that sticking to a disciplined, long-term investment strategy built around their goals matters most. Your retirement plan and investment strategy shouldn’t drastically change direction based on the shifting political winds—they should be constructed to withstand them and keep you on track, no matter who is in office.

Secure Your Financial Future with Burgos & Brein Wealth Management.

With the election cycle approaching, it’s natural to have concerns about your investments. The emotional climate can make it difficult to see clearly.

At Burgos & Brein Wealth Management, we understand. Our experienced advisors can provide objective guidance to ensure your financial plan remains on track, regardless of the political landscape.

Don’t let election uncertainty cloud your financial future. We’ll help you make informed decisions based on your long-term goals.

Contact Burgos & Brein Wealth Management today to schedule a consultation. Call us at 407-378-2121.

Invest with confidence. Invest with Burgos & Brein.

Disclaimer:

Past performance does not ensure future results. Every investment carries risk, including potential loss of invested principal. No investment strategy can guarantee success.

Recent Comments